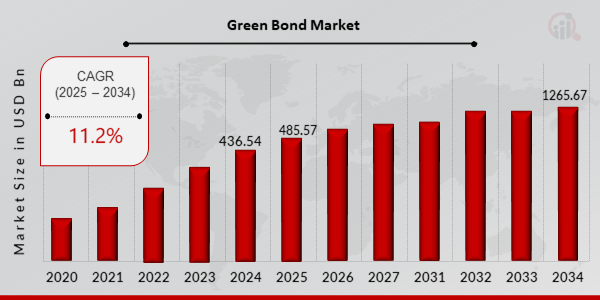

Green Bond Market Projected for 11.2% CAGR, Reaching 1265.67 Billion by 2034

Green Bond Market Growth

Green Bond Market Research Report By, Issuer Type, Use of Proceeds, Bond Type, Currency, Regional

AZ, UNITED STATES, January 14, 2025 /EINPresswire.com/ -- The Green Bond Market has emerged as a cornerstone of sustainable finance, enabling governments, corporations, and financial institutions to fund environmentally friendly projects. In 2024, the market size was valued at USD 436.54 billion and is projected to grow from USD 485.57 billion in 2025 to an impressive USD 1265.67 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 11.2% during the forecast period (2025–2034).

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

➤ Rising Focus on Climate Change and Environmental Sustainability

The growing urgency to combat climate change has led to increased funding for renewable energy, sustainable infrastructure, and eco-friendly initiatives. Green bonds are playing a pivotal role in channeling capital toward these projects, driving market growth.

➤ Supportive Regulatory Frameworks and Government Policies

Governments worldwide are implementing policies to encourage green financing. Tax incentives, subsidies, and carbon reduction goals have motivated organizations to issue green bonds, enhancing market development.

➤ Increased Investor Demand for ESG Investments

Environmental, Social, and Governance (ESG) investing has become a priority for institutional and retail investors. Green bonds align with ESG criteria, making them an attractive option for socially responsible investment portfolios.

➤ Advancements in Certification Standards

Global frameworks like the Green Bond Principles (GBP) and Climate Bonds Standard have established clear guidelines for the issuance and verification of green bonds. These standards enhance transparency and credibility, boosting investor confidence.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 https://www.marketresearchfuture.com/sample_request/22847

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐆𝐫𝐞𝐞𝐧 𝐁𝐨𝐧𝐝 𝐌𝐚𝐫𝐤𝐞𝐭

• JP Morgan Chase

• UBS

• BNP Paribas

• Deutsche Bank

• Societe Generale

• Barclays

• Bank of America

• Royal Bank of Scotland

• Morgan Stanley

• Goldman Sachs

• HSBC

• Rabobank

• Credit Suisse

• Citigroup

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.marketresearchfuture.com/reports/green-bond-market-22847

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

To provide a comprehensive analysis, the Green Bond Market is segmented based on issuer type, use of proceeds, and region.

1. By Issuer Type

Corporates: Increasingly issuing green bonds to finance sustainability initiatives and reduce carbon footprints.

Governments and Municipalities: Funding large-scale renewable energy and climate-resilient infrastructure projects.

Financial Institutions: Playing a critical role in channeling funds to eco-friendly ventures through green bonds.

2. By Use of Proceeds

Renewable Energy Projects: Solar, wind, and hydropower initiatives dominate the market.

Energy Efficiency: Investments in green buildings and energy-saving technologies.

Sustainable Transport: Development of electric vehicle infrastructure and public transit systems.

Water and Waste Management: Financing projects for clean water access and efficient waste recycling.

3. By Region

North America: Significant growth driven by corporate issuance and supportive policies in the U.S. and Canada.

Europe: Leading the market with stringent environmental regulations and ambitious climate goals.

Asia-Pacific: Fastest-growing region due to rising green investments in China, Japan, and India.

Rest of the World (RoW): Growth in Latin America, the Middle East, and Africa fueled by international funding and infrastructure development.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22847

The Green Bond Market is positioned to play a transformative role in achieving global sustainability goals. As the world intensifies its efforts to transition to a low-carbon economy, the demand for green bonds is expected to surge. With continued innovation in green finance products, increased investor awareness, and government support, the market is set for substantial expansion. By enabling the flow of capital into environmentally sustainable projects, the green bond market is not only fostering financial returns but also driving meaningful impact on the planet's future.

Related Report -

Insurance Agency Software Market

Lease Accounting And Management Software Market

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release