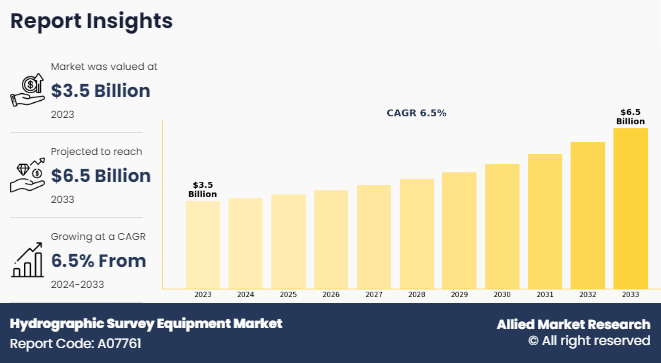

Hydrographic Survey Equipment Market is Predicted to Reach USD 6.5 billion at a CAGR of 6.5% by 2033

Hydrographic Survey Equipment Competitive Landscape and Trend

On the basis of type, the software segment held the largest share in the hydrographic survey equipment

WILMINGTON, DE, UNITED STATES, March 7, 2025 /EINPresswire.com/ -- The global hydrographic survey equipment market size was valued at $3.5 billion in 2023, and is projected to reach $6.5 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/A07761

The hydrographic survey equipment market is experiencing significant growth driven by advancements in technology and increasing demand from various sectors such as offshore oil and gas, maritime safety, and environmental monitoring. The adoption of autonomous systems like unmanned surface vehicles (USVs) and advanced sonar technology has enhanced the accuracy and efficiency of hydrographic surveys, enabling deeper and more comprehensive ocean exploration.

Furthermore, one major trend is the integration of cloud computing and real-time data analytics, which allows for faster data processing and improved decision-making during surveys. the rise in focus on renewable energy, particularly offshore wind farms, has led to a surge in demand for hydrographic equipment to conduct seabed mapping and underwater infrastructure inspections.

In addition, the hydrographic survey equipment industry is witnessing trends such as the integration of artificial intelligence (AI) and machine learning (ML) for enhanced data interpretation and automated survey processes. The increasing use of unmanned aerial vehicles (UAVs) and unmanned surface vessels (USVs) in surveys for remote and hazardous environments is also growing. Moreover, there is rising demand from environmental monitoring, offshore renewable energy, and coastal management projects, driving innovation in sonar systems and real-time data analytics for more efficient and accurate mapping.

Furthermore, major market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in February 2024, Terradepth, an ocean data-as-a-service company, partnered with Hypack, a leader in hydrographic survey software, to enhance the hydrographic survey workflow significantly. This partnership allows surveyors to run Hypack’s software directly in the cloud via Terradepth’s Absolute Ocean platform, addressing the traditional challenges faced by surveyors that previously relied on local data processing. Such conventional methods often involved delays in data sharing and processing due to dependency on physical hard drives or slow file hosting services. With this integration, hydrographic surveyors can now process ocean data in near-real time during surveys, seamlessly contextualizing it with existing geophysical data. As a result, the time from data collection to actionable insights is dramatically reduced, with lead times shrinking from weeks to mere hours, thereby streamlining operations and enhancing efficiency in the industry.

Procure Complete Report (386 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/9fbca284a534d075dbfe7dd5a5839128

Moreover, in March 2024, Teledyne Marine launched Slocum Sentinel Glider, which enhances its portfolio of underwater vehicles and survey technologies. In a strategic move to bolster its capabilities in the oceanographic and hydrographic instrument market, Teledyne also announced the acquisition of Valeport, a UK-based company renowned for its advanced measurement technologies. This dual initiative is expected to strengthen Teledyne's position in marine data collection and expand its product offerings, catering to the growing demand for sophisticated underwater monitoring solutions.

By Depth

On the basis of depth, the shallow water segment attained the highest market share in 2023 in the hydrographic survey equipment market size. This is due to its wide use in coastal management, port and harbor development, and offshore renewable energy projects. Shallow water surveys are essential for safe navigation, environmental monitoring, and infrastructure development, which are increasingly required in coastal regions. The relatively lower cost and ease of deploying equipment in shallow waters compared to deep-water environments contribute to its dominant market share. Meanwhile, the deep-water segment is projected to be the fastest-growing segment during the forecast period due to increasing demand for deep-sea exploration, offshore oil and gas projects, and subsea infrastructure developments. The need for accurate mapping and surveying in deeper ocean environments has driven advancements in technology, enabling more efficient data collection. Rise in interest in deep-sea minerals, marine biodiversity, and global ocean mapping projects has further accelerated demand for deep water hydrographic survey equipment market share.

By Platform

On the basis of platform, the surface vessels segment attained the highest market share in 2023 in the hydrographic survey equipment market growth as due to their versatility and capacity to perform extensive surveys across various applications such as bathymetric mapping, port and harbor management, and offshore infrastructure monitoring. Surface vessels are equipped with advanced sonar systems, allowing accurate data collection in both shallow and deep waters. Their broad operational range, ease of deployment, and increasing use in environmental studies and defense have contributed to the rapid growth in demand for surface vessel-based hydrographic surveys. Meanwhile, the aircraft segment is projected to be the fastest-growing segment during the forecast period due to its ability to cover large areas quickly and efficiently. Aerial surveys using advanced LiDAR and imaging technologies enable high-precision data collection in hard-to-reach or remote locations. This capability is increasingly valuable for coastal mapping, offshore exploration, and environmental monitoring, driving its rapid adoption.

By Region

On the basis of region, North America attained the highest market share in the hydrographic survey equipment market due to the region's robust investments in maritime infrastructure, offshore energy exploration, and defense activities. The U.S. and Canada’s advanced technological capabilities, coupled with extensive coastlines and active seafaring industries, drive demand for accurate marine mapping and navigation. North America's growing focus on environmental monitoring and offshore oil and gas operations further boosts the demand for hydrographic survey equipment, contributing to its market dominance.

On the other hand, Asia-Pacific is projected to be the fastest-growing region for the hydrographic survey equipment market demand during the forecast period. This is due to increasing maritime activities, rapid expansion of offshore oil and gas exploration, and the region's growing focus on port infrastructure development. Countries like China, India, and Japan are investing in coastal and marine projects, driving demand for advanced hydrographic technologies. Furthermore, the region's commitment to enhancing national security through naval modernization and environmental monitoring initiatives supports the accelerated adoption of hydrographic survey equipment market analysis.

The study provides Porter’s five forces analysis to understand the impact of several factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the hydrographic survey equipment market trends.

The Impact of the Russia-Ukraine War

The Russia-Ukraine war has had a significant impact on the hydrographic survey equipment market by disrupting global supply chains and causing delays in the production and delivery of essential components. Additionally, heightened geopolitical tensions have shifted priorities toward defense spending, potentially diverting funds from civil marine projects. On the other hand, increased focus on maritime security and defense operations in the region could drive demand for advanced hydrographic survey equipment for naval and border surveillance, particularly in affected European countries seeking to strengthen coastal defense and surveillance capabilities.

Inquiry Before Buying @ https://www.alliedmarketresearch.com/purchase-enquiry/A07761

Key Findings of the Study

On the basis of type, the software segment held the largest share in the hydrographic survey equipment in 2023.

By Platform, the surface vessels segment held the largest share in the market in 2023.

By Application, the offshore oil and gas survey segment held the largest share in the market in 2023.

By End User, the commercial segment held the largest share in the market in 2023.

By Depth, the shallow water segment held the largest share in the market in 2023.

On the basis of region, North America held the largest market share in 2023.

Key players operating in the global hydrographic survey equipment includes Edgetech, Fugro N.V., Innomar Technologie GmbH, Ixblue SAS, Kongsberg Gruppen ASA, Mind Technology, Inc., Sonardyne International Ltd., Syqwest Inc., Teledyne Technologies Inc., Tritech International Ltd., and Valeport Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the Hydrographic survey equipment market.

Related Reports:

Aircraft Micro Turbine Engine Market

Aircraft Fuel Systems Market https://www.alliedmarketresearch.com/aircraft-fuel-systems-market

Aircraft Seating Market https://www.alliedmarketresearch.com/aircraft-seating-market

Hydrogen Aircraft Market https://www.alliedmarketresearch.com/hydrogen-aircraft-market-A08743

David Correa

Allied Market Research

+15038946022 ext.

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

Distribution channels: Aviation & Aerospace Industry, Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release